Episode Transcript

Transcripts are displayed as originally observed. Some content, including advertisements may have changed.

Use Ctrl + F to search

0:00

The Principles

0:02

of Economics

0:06

Principles of Economics, my complete

0:08

guide to understanding economics, is

0:10

now available in hardcover, audiobook

0:12

and e-book from safedean.com, Amazon

0:14

and many more booksellers worldwide.

0:17

And now I am also teaching a

0:19

course based on this book on my

0:21

website safedean.com. Principles of

0:23

Economics will run the whole academic year,

0:25

from September to June, and will have

0:28

a new lecture every two weeks, as

0:30

well as weekly live online discussion seminars

0:32

open to learners from all over the

0:34

world and from all walks of life.

0:37

Whether you're a student, a professional

0:39

or a retiree, you are making

0:42

economic decisions every day, and

0:44

this course will arm you with the

0:46

wisdom of centuries of economists to improve

0:48

your economic decision making. You'll

0:51

also get a free book of Principles of Economics if you sign

0:53

up for the course. Go to safedean.com

0:55

and sign up now. The

1:25

Bitcoin Standard podcast is brought to you by CoinKite.

1:28

CoinKite are my favorite makers of Bitcoin

1:30

hardware. They produce the legendary OpenDime, the

1:32

first Bitcoin bearer asset, as

1:35

well as the reliable Cold Cold Coin, and

1:38

the most popular Bitcoin dealer in the world. CoinKite

1:41

is an open-source app that is available for

1:43

free at the local store. CoinKite is

1:45

a free platform that is available for free at the

1:47

local market. It's free at the local market, the

1:50

legendary OpenDime, the first Bitcoin bearer asset,

1:53

as well as the reliable Cold Card Hardware

1:55

Wallet, the excellent stainless steel seed plates for

1:57

storing your seed phrases, and the

1:59

block clock. Now, Coinkite have produced

2:01

the Sats card, a card the size

2:03

of a credit card which can store Bitcoin

2:05

and works great as a gift. Coinkite

2:09

have just produced a limited edition

2:11

gorgeous Bitcoin Standard Sats card which

2:13

carries the Bitcoin Standard logo and

2:15

you can get it from Coinkite.shop

2:17

slash Bitcoin Standard. Use the code

2:20

Bitcoin Standard to get 5% off your purchase. This

2:23

podcast is also brought to you

2:25

by the Bitcoin Way, your professional

2:27

Bitcoin IT team, offering you personalized,

2:29

secure and comprehensive solutions for every

2:31

step along your Bitcoin journey. The

2:34

Bitcoin Way offer live concierge

2:36

service to guide you with

2:38

your Bitcoin cold storage, running

2:40

your node, privacy best practices,

2:42

inheritance planning, corporate strategy and

2:44

multi-sig solutions. They don't touch

2:47

your coins, they guide you through the process

2:49

of acquiring your coins and securing them. If

2:51

you'd like to make your setup safer and

2:53

more reliable, book a consult with them and

2:55

see what they have to suggest. If

2:58

you want to give someone the gift of

3:00

Bitcoin, get them this professional service that would

3:02

ensure they start off knowing exactly how to

3:04

manage their coins and not lose them. Go

3:07

to the bitcoinway.com and start

3:10

Bitcoining more confidently. Hello

3:18

and welcome to the Bitcoin Standard Podcast. Our guest

3:21

today is Obi Nwosso. Obi is

3:23

the CEO of FediMend, a

3:26

new e-cash implementation on Bitcoin that's

3:28

interoperable with Lightning. I think

3:30

this is a very interesting scaling project

3:33

for Bitcoin. I've spoken

3:35

about it to Obi a few weeks

3:37

ago in Seoul in South Korea. We

3:39

were there together both for a conference

3:42

and I thought it would be

3:44

great to bring him on here so we could discuss

3:46

it further. So Obi, thank you so much for joining

3:48

us. Thank you. Thank

3:50

you very much. Just one thing to clarify, I'm

3:53

the CEO of Fedi, but

3:55

I'm a big, big fan

3:57

of the protocol FediMend and

3:59

Fedi. And

32:02

hopefully over time, self custody gets easier and

32:04

easier and easier. So more and more people

32:06

fit that sort of ideal scenario.

32:09

But this is going to be a spectrum.

32:11

And I expect that a large

32:14

percentage of these end nodes will

32:16

be Fedimans, some

32:19

small percentage will be decentralized

32:21

parties like exchanges and banks,

32:24

and then hopefully the largest in

32:26

terms of nodes will be self

32:28

custodial wallets for

32:30

the people who have made its fruit

32:33

to that point. Yeah, and I

32:35

think this is the this is just natural. I

32:37

think a lot of people have this misconception in

32:39

their mind that either

32:42

Bitcoin gives everybody their own private central

32:44

bank, and that allows them to

32:46

conduct on chain transactions every time they want

32:49

to buy a coffee, or

32:51

it's failed, or it's failed completely.

32:54

And it's a little bit like saying

32:56

aviation has failed over the last

32:58

100 years because it's still not

33:01

given us teleportation. So

33:03

we've gone from riding donkeys

33:05

to supersonic flight.

33:08

That's a huge improvement. It would have taken you years

33:11

to travel across, say, Africa.

33:17

Now it takes you a few

33:20

hours. That's not nothing. It's a huge

33:22

and enormous improvement. But if

33:24

your definition of success is

33:26

that it has to be

33:29

teleportation or else donkey win,

33:31

then you're going to be stuck with

33:34

donkeys because I don't think

33:36

we're getting teleportation anytime soon. And

33:38

I think this is really the case with Bitcoin. It

33:42

would be nice if everybody could have

33:44

their own on-chain transaction for every single

33:46

thing, but realistically, it can't really happen.

33:49

We can't have this enormous amount

33:51

of redundancy

33:53

where everybody in the world records

33:56

everybody else's coffee transaction because

33:58

A, you don't need that. level of

34:00

security for your coffee transaction. It's entirely,

34:03

entirely feasible to trust somebody in the

34:05

processing of this payment and then settle

34:07

your account with them at the end

34:09

of the month. You trust

34:12

them to hold

34:14

your money and pay, or they trust you to settle your

34:16

account at the end of the month. It's

34:19

a profitable business relationship for both of you

34:21

and they'll likely make it. And if it's

34:24

only for pocket money, then yeah, it's

34:26

not foolproof and they might rug you. But

34:29

everything in life involves trusting people. You trust

34:31

your laptop maker that the laptop is not

34:33

going to blow up. You trust the airplane.

34:36

You trust your restaurant. And you don't trust them

34:38

because you just think they're good people. You trust

34:40

them because you realize there are incentives involved and

34:44

efficiencies. The

34:48

alternative is you're not going to have a laptop

34:50

if you wanted to make it yourself in order

34:52

to trust everybody. So I think

34:55

people need to be realistic about Bitcoin in

34:57

this regard. We've got currently capacity for half

34:59

a million, 1 million transactions a day. That's

35:02

not enough for a neighborhood in a big city. There

35:06

are many, many more transactions taking place in the

35:08

world and it's just never going to be

35:10

the case that all of these transactions are going to fit

35:12

on chain. So that

35:15

doesn't mean Bitcoin fails because what

35:18

matters ultimately is, is Bitcoin

35:21

decentralized enough for it to continue to

35:23

work successfully without being compromised? Bitcoin

35:26

has to give you your coffee on

35:28

chain in order for it to work. I think this

35:30

is the thing. It would be nice and

35:32

of course there's a lot of purity

35:36

signaling where people just want to

35:38

appear like they're internet tough guys

35:40

and so they know we will

35:43

not accept any solution that doesn't allow

35:45

me to trustlessly buy my 99

35:48

cent coffee without

35:50

having to trust anybody in the world except

35:52

the coffee maker. It's

35:55

not going to happen. Ultimately there are

35:57

trade-offs involved and the on-chain transactions are going

35:59

to continue need to be the most valuable

36:02

transactions. They're going to command the

36:04

highest transaction fees, but

36:06

everything else is likely going to

36:08

offer trade-offs in terms of security,

36:12

trust, and reliability

36:14

and speed and scaling and transaction

36:16

fees. And people

36:19

need to be realistic about this. And I think this

36:21

offers a very interesting set

36:24

of trade-offs that I think likely

36:26

will appeal to a lot

36:28

of people. And I think,

36:30

yeah, the analogy, like the donkey

36:32

versus teleportation, to take another

36:36

one, probably less humorous, but it's also

36:38

an interesting way of thinking about it

36:40

is transportation

36:42

in terms of wheel transportation or

36:46

just mass transportation versus personal. We

36:49

have the ability to

36:52

travel personally. You can, if

36:54

you can afford it by your own car. There's

36:58

a big investment, but then you have

37:00

the ability to drive by yourself. Now

37:04

there are people who share

37:06

transportation and they might share their

37:08

car or their

37:10

larger car with a number of people in the family, or

37:13

you go even further and you have

37:15

buses and you go

37:17

even further and you have trains, which transport

37:20

multiple people. But the people who've chosen them,

37:22

chosen to use a train or a bus

37:25

are delegating some trust to

37:27

the driver of the conductor

37:30

and driver of the bus or

37:34

the operator of the train. But

37:37

you wouldn't say transportation or wheel

37:39

transportation failed because they exist. This

37:43

is lower cost, it's more efficient, and

37:46

there are benefits of using those

37:49

systems, but you have the option

37:51

to go to self-driving, driving yourself,

37:53

not self-driving, we're not going into

37:55

Tesla, but driving yourself if you

37:58

so wish. And

38:00

that means that the technology of

38:02

transportation has that optionality. But I

38:04

do think that when

38:07

it comes to buying the proverbial cup of

38:09

coffee, there's a reason why Eric made his first

38:11

transaction a cup of coffee. Because

38:14

almost like the third of, I

38:17

believe it was the third of October 2021, is

38:20

effectively in my mind sort of e-cash

38:23

coffee day, if you would

38:25

put it into, because I think buying cups

38:27

of coffee for

38:29

most people won't happen on

38:32

the main chain. Because the

38:34

on-chain fees will be several

38:36

orders of magnitude, probably more than the cost of

38:39

the coffee. And it

38:41

probably won't happen very frequently over

38:43

lightning either. It will probably happen

38:45

in e-cash, because

38:48

that will make sense for that.

38:50

Now, if you are paying for,

38:54

I don't know, something that could cost a

38:57

round of shopping in a department

38:59

store for clothes, et

39:01

cetera, or your weekly shopping, you may choose

39:03

to pay that in e-cash

39:06

or lightning. And if you're buying

39:08

a house or a major investment,

39:11

you may do that on-chain. You

39:13

know, because it's because of the nature

39:15

of the transaction. But you

39:17

probably don't need the same security guarantees for

39:19

a cup of coffee that you need for

39:21

buying your house. Yeah,

39:24

exactly. So how

39:27

is progress going with your attempt to... Or

39:30

I mean, before we move on to that, do you want to talk a

39:32

little bit more about these trade-offs or

39:34

how you see these blaming out? Do

39:36

you have anything more to add on

39:39

that? No, I've seen. We

39:41

discussed the main trade-off, and there are

39:43

many ways to mitigate that. Because

39:46

that's the biggest trade-off. And

39:48

if you try to, you can

39:50

try to avoid this. There's other people who

39:52

are attempting to scale Bitcoin. And

39:55

the way they're trying to do that is to

39:57

still retain as much of this

39:59

trust as necessary. nature of

40:01

Bitcoin as possible. But

40:04

you always run into scaling limitations.

40:06

If you have significant

40:09

increase in complexity, and

40:12

at the end of the day, you have a 5, 10, maybe

40:16

50X increase in transaction

40:19

throughput, but for massive increase in

40:21

complexity, so much

40:24

so that if you think about Lightning, which

40:26

is an incredible protocol and is

40:29

now being used, and

40:31

it's relatively simple protocol, it

40:33

took seven years or more to get to

40:35

the state where it's actually being used and

40:37

reliable. So if you're starting now with a

40:40

protocol that's several orders

40:42

of magnitude more complicated than Lightning,

40:44

then realistically, you're going to have

40:46

to wait probably that long, if

40:48

not longer, for it

40:50

to potentially give you a 10X increase, when

40:52

what we really need is a 10,000X increase.

40:56

And that only can come from removing

40:58

this link, but

41:01

then there is some elements of trust. So

41:04

it's important to think about the end

41:06

state when you're deciding you want to

41:08

increase transactions. But on the E-CASH side,

41:11

there are things we can do to

41:13

reduce the risk. One

41:16

is recognize that there's some level of

41:18

trust that's being required, and

41:20

therefore, put a lot of effort in

41:22

deciding, determining who you trust. So

41:25

there are protocols built on NOSDA

41:28

that were championed by the guys at Mutant E-ring things,

41:31

really cool idea, where we use

41:33

NOSDA's web of trust to help

41:35

determine which means you

41:37

can trust or not. There

41:40

are protocols as well, which

41:43

Eric originally talked about over

41:46

about a couple of years ago, where the

41:50

only way to know if any form of

41:52

custodian is solvent is to do a run

41:54

on the back. So to put

41:57

everybody to leave, that's the only way you know.

42:00

There could be mechanisms to

42:02

have automated runs on

42:04

the bank where everybody at some random

42:07

time does a mass exit

42:09

to another federation. As the federation

42:11

doesn't know when that's going to happen, they

42:15

always have to be on their toes. Again,

42:18

that can help keep them honest. We

42:21

can take these approaches to reduce the risk,

42:25

to know of a bank solvent. There

42:28

are mechanisms to help provide cryptographic proof

42:30

of reserves to some eighth degree. But

42:33

remember, because this is perfectly private, they're

42:36

always limited. Runs

42:38

on the bank and

42:40

mechanisms to trust the counterbodies. A big

42:43

part of of

42:45

FediMinton, what we recommend

42:47

at Fedi is to

42:49

know your not KYC,

42:51

but KYF. Know your

42:53

friend, know your family, know your federation.

42:56

So find mechanisms, either through

42:58

webs of trust or personal contact to

43:01

identify who are the people who are holding

43:03

the keys, especially if they're in a local

43:05

community and they're physically

43:07

local to you. That

43:10

also that physicality, just like the physicality

43:12

behind Bitcoin, the fact that it's backed

43:14

by actual energy.

43:17

If you have a physical

43:19

community where the custodians are

43:21

actually physically proximate to you,

43:24

then you can always, if they tried

43:26

to do something, walk up to them

43:28

and physically question

43:33

them as to why they're not doing

43:35

what they're supposed to be doing. So

43:38

that, again, at this hyper-local

43:40

level where you'll have mints

43:42

around the world becomes possible,

43:44

even though the Lightning Network

43:46

still gives you access to

43:48

the global economy. Most

43:50

transactions in most people's lives are

43:52

local. Their food they buy locally.

43:55

Their accommodation is local. Their transport by

43:57

definition of themselves, their own body. is

43:59

local. These make up the majority of

44:01

expenditures for most people on a day

44:04

to day. If you want to buy

44:06

your Netflix subscription, that goes over the

44:08

Lightning Network. And if you

44:10

want to buy a house, you buy

44:12

that in Bitcoin. But your day to

44:14

day transactions will be local. And so

44:16

we expect these mints to be hyper

44:18

local. Yeah, and I think this is

44:20

just inevitable that people are going to

44:22

trust people that are around them. No

44:25

matter what Bitcoin's scaling limitations

44:28

are, it's inconceivable

44:30

that every person is going to be

44:32

running their own note. There are children

44:34

out there, there are old people out

44:36

there, there are people that aren't very

44:39

comfortable running all those things. And

44:42

that's fine. These people aren't just out there in

44:44

a world, you know, in

44:47

a dark world on their own, left

44:49

to fend for themselves. They have families,

44:51

they have children, they have parents, they

44:53

have friends and family.

44:56

And they live together in small communities

44:58

in which there's repeated interaction. So your

45:00

neighbor can't just rug you because then everybody else

45:02

in the neighborhood is going to. Well, I mean,

45:04

no, I mean, you come straight out of the

45:07

womb and I guess you're supposed to, you're already

45:10

creating your 12 word seed. Well, I mean, if you can't

45:12

do it, then obviously Bitcoin has failed. If you can't do

45:14

it out of the world, clearly,

45:16

we might not, we might as well not bother

45:18

and stick to the Federal Reserve, because

45:20

that's clearly workable for everybody. Because

45:22

just trust the US government. I

45:27

mean, and actually, to your point, in the

45:29

world of AI, we're going

45:31

to see increasing, I don't want to make

45:33

this an AI discussion, but it's,

45:35

it's, again, if you extrapolate the

45:39

idea of what is

45:42

true online is

45:45

going to become more and more

45:47

apparent. It's already the case that you

45:49

shouldn't trust what you see online, but

45:52

this is not a truth that is

45:55

apparent to everybody in

45:57

a world of deep fakes becoming increasingly easy. easy

46:00

to make. When

46:03

the first story of some kid at

46:05

school posting a lewd

46:07

picture or a lewd video

46:09

of their school

46:11

teacher doing something gets public

46:14

and gets

46:16

talked about by mainstream media, well, you know what

46:18

every other kid in every other school is going

46:20

to do the following day. They're all going to

46:22

do it. And at that point, the penny will

46:25

drop and people will realize

46:28

that if something is intermediated

46:31

by a screen, you

46:34

cannot actually trust it. This this

46:36

I might be OB or I

46:38

might be, you know, you

46:41

know, Janet, who's

46:45

from, you know, Botswana,

46:48

who's pretending to be OB. You

46:50

can't really know. We

46:52

can guess that the technology hasn't got there right now, but

46:55

within a year or two, it will get there. And

46:58

the only and I would posit

47:00

that that will lead to a

47:02

return to physical communities. Physicality is

47:04

a solution, whether it's some money

47:09

with Bitcoin and the combination

47:11

of that. And then you

47:13

can expand that globally using public

47:16

private key encryption, etc.

47:19

But you start the base. The

47:21

route has to be physicality

47:23

meeting someone in person, forming

47:26

a web, forming a connection

47:28

that you have provably

47:30

made using public private

47:32

key encryption sign transactions

47:34

proving that you've met.

47:37

And then you extend that through your web of

47:39

trust. So protocols like nostra and

47:41

others can extend that. So if I meet

47:43

someone online who I've never

47:46

met in person, I can

47:48

look at the connections between them

47:50

and myself and form a view of

47:52

how much I trust them. But

47:56

the core root there will be

47:58

encryption. physical

48:00

world. And I think understanding

48:04

that will drive back this need

48:07

for trusted communities just

48:10

to be able to operate in

48:13

this post-truth world. And

48:16

so I think then the idea

48:18

of these fedamints that are built

48:20

up around communities as well will

48:23

make even more sense. And the idea of

48:25

money that's backed by some physical force

48:28

of energy again will just start to make more

48:30

and more common sense to more and more people.

48:33

Yeah, I think so. And I think this is really,

48:36

once you start understanding there are

48:39

inevitably going to be these kind of trust

48:43

solutions, then the scaling problem

48:45

of Bitcoin begins to

48:48

seem a lot more attractable. So initially, when you think,

48:50

hang on a second, this is only half a million

48:52

transactions a day or many transactions a day, but we

48:54

have 8 billion people, there's no way this is going

48:56

to work. Then you remember, well, if

48:59

every couple of hundred people congregate

49:02

around one node, and that's entirely feasible. I

49:05

mean, the 150 is the Dunbar number. That's

49:07

a number of a

49:11

small community where everybody knows each other and

49:13

everybody can have a relationship with one another.

49:16

And so if you get every

49:18

150 people on one node, you've

49:21

already reduced the scale of

49:23

the magnitude of the scaling

49:26

problem enormously. And then when you

49:29

think about the ability to open

49:31

lightning channels, that also increases

49:33

it. So then it's not

49:35

just that everybody uses a node

49:38

and then they all share in their

49:40

own on-chain transactions. They open a lightning

49:42

channel once or two, three, four,

49:44

five lightning channels, and then they can transact with everybody

49:46

in the world at

49:49

a much, much lower cost. And then as

49:51

you said, the physicality, I think is

49:54

a great idea. I'm a big fan of

49:56

OpenDimes and they're, you know, CoinKite are one

49:58

of the sponsors of this. podcast. I'm

50:01

a big fan of these things. Every time I want to orange

50:03

bill somebody, I want to give somebody a gift of Bitcoin, I'd

50:05

like to give them open dimes. And it's

50:08

occurred to me once that open dimes really

50:10

are an incredible way of scaling Bitcoin, because

50:12

we could get to a point where you

50:15

could start making physical open

50:18

dimes that show their

50:20

denomination. So this is

50:22

1000 sats, and it's

50:24

a USB, like the

50:27

open dime, and it has a 1000 sats on it. And

50:29

then that just becomes a form of money that people can

50:31

use physically because they trade

50:33

with one another, and then they can check the

50:36

validity anytime they want to exchange it. And now

50:38

you've got a bearer asset.

50:41

And then think about how many transactions you can build

50:43

with those bearer assets for all

50:45

your day to day trade where things don't

50:47

need to go through on

50:49

chain transactions. And then

50:51

you can think about what you could do

50:53

with these bearer assets, where you could have

50:56

them with a custodian and the custodian can

50:58

issue paper money

51:00

backed by these bearer assets. And

51:02

then you're even adding more and more opportunities

51:05

for scaling. Yes, of course, there are

51:07

trade offs involved and there is trust

51:09

involved here, but it's still a solution

51:12

that's going to be workable for a lot of people,

51:14

I think. Yeah, I think

51:16

I'm a big fan of

51:19

Rodolfo and an open dime. And

51:21

I think

51:25

you've hit the nail on the head. Open

51:28

Dime is and e-cash

51:30

are conceptually very similar.

51:33

Effectively, the mint in

51:35

open dime is coin

51:37

kite, they're minting these. Although

51:40

it's slightly different because with open

51:42

dime, it

51:44

comes empty. You can

51:52

add your own Bitcoin onto it. But if

51:55

the scenario you said words

51:58

transpired, then it would come pre-incented. installed

52:00

with a certain amount of Bitcoin. This

52:03

was done with the Cassaceous coins. Whenever you see

52:05

a picture of Bitcoin, they show this coin and

52:08

it's got the Bitcoin symbol on it. Many

52:11

of those are Cassaceous coins, which

52:14

were pre-installed, pre-deposited. They're

52:16

a hardware wallet that

52:20

you can peel off, scratch the

52:24

fluorescent, not fluorescent, iridescent

52:30

sticker at the back, and it will show you

52:32

the private keys, and then you can install that

52:34

into a wallet and spend the money. But

52:37

if you receive one of those and you see that

52:40

it hasn't been tampered with, then

52:42

you can be comfortable that,

52:46

and you can check online if you want to, the balance, but

52:48

you can be comfortable that it's holding a certain amount of Bitcoin.

52:51

And it's at, but conceptually,

52:53

intuitively for a user, it's

52:55

very, very understandable. This is

52:58

a thousand sets and it's on a coin, and if

53:00

I give it to you, you

53:02

now have the thousand sets and I don't have the

53:04

thousand sets. All the other person needs to do

53:06

is check that it hasn't been tampered with and

53:09

they can proceed.

53:12

But once you see that, you realize

53:14

there's no real scaling limits to that. If

53:17

there were a million of those coins

53:20

and a million different people at the

53:22

same second gave their coins to a

53:24

different person, then you would

53:26

have, you just did a million transactions in a second.

53:29

And you could, there was

53:31

no scaling limitings because each transaction

53:33

happens peer to peer. eCash is

53:35

the same property. Once you

53:38

have the eCash on your phone,

53:40

it literally is files on your

53:42

phone. So if there's a

53:44

billion people in the planet who had

53:46

eCash and just by coincidence,

53:48

the same second, they chose to give

53:50

it to a billion different people. Then

53:53

in that one second, you did a billion transactions

53:56

and there was no problem because each one

53:58

was a peer to peer. transfer of

54:00

a file locally and

54:03

no other system has that scaling property.

54:07

It does mean though there is some level

54:09

of trust but again the privacy

54:12

properties actually help to

54:15

reduce that trust because it

54:18

is not possible for a mint

54:21

to be able to say you

54:25

safe have a

54:27

certain amount of e-cash

54:30

and I'm going to invalidate your e-cash.

54:33

I have to invalidate. I

54:35

have to invalidate everybody's

54:37

e-cash or debase

54:39

everybody's e-cash or no ones.

54:42

I cannot surgically

54:46

attack one person even though

54:48

I've been responsible for minting

54:50

or redeeming everybody's e-cash within

54:52

that mint. And so

54:55

that means that the stakes

54:57

for the mint are much

54:59

higher. If they are going to do

55:02

something they have to again because it's

55:04

federated they have to do it

55:06

as the majority. Second, if

55:10

they were to do something they have to do it if

55:13

people have been joining federations

55:15

where they trust against friends and

55:18

family or people who are in their network

55:20

of trust so they have to spend social

55:22

capital. And finally they could

55:24

be physically proximate as well so there's

55:26

some physical risk to them if they

55:29

were to do this. If you combine

55:31

those three things together there's a lot

55:33

of disincentives. I remember if they

55:35

don't do anything and if they just keep

55:39

their computer because it all just

55:41

runs automatically like a bitcoin node.

55:44

So then if they keep

55:46

their computer fed and water with internet

55:48

electricity they have the potential to have

55:52

many benefits from being a guardian

55:55

without doing much work. So the effort

55:57

to benefit is very low. to

56:01

collude and cause damage is

56:03

very high. And if

56:05

you've chosen trusted guardians, the

56:07

risk to those guardians is very high as well. Yeah,

56:10

it's very interesting. Okay, so

56:12

how's progress going? So I remember

56:15

you mentioning in Seoul that you

56:17

guys have been working

56:19

with some small communities all

56:21

over the world trying to get

56:23

them started on this. Tell us more

56:25

about these experiments and how they're going. Yeah, so

56:29

there's FediMint and Fedi. So FediMint

56:31

is now one of the

56:33

most active projects in the Bitcoin ecosystem. It's

56:37

got 40 plus contributors. It's

56:40

now very, very stable, very

56:43

reliable. It can support

56:47

single user,

56:49

non-federated, unfederated mints for

56:52

small amounts, if that's what you so wish to do. Obviously

56:55

you don't have the benefit of being federated and it

56:57

can support federations of four

56:59

or more tested up to 40

57:01

people, which is the Bitcoin

57:04

standard, is the

57:06

recommended way to operate because

57:08

it's the lowest risk. And

57:11

it continues to be worked on more

57:13

and more features added all the time, but it's a very,

57:15

very reliable protocol already. And

57:18

then Fedi is one of

57:20

a number of companies and we're

57:22

seeing more, which have chosen to

57:24

use this as a base for

57:27

a Bitcoin wallet. In our case, we

57:29

call it a community super app because

57:31

it not only does it have the

57:33

FediMint protocol to provide the custody elements,

57:36

it also has the Lightning integration to access

57:38

the Lightning network, obviously

57:40

Bitcoin because the base money is Bitcoin.

57:43

And it also has integration with things like

57:45

Noster for

57:47

social connection and login

57:50

and matrix for communication within the app. So

57:53

that's been built. We're now

57:55

at what we call Fedi Bravo, which is like

57:57

the beta version and coming. say

1:04:00

I'm to now I realize how close I'm to

1:04:02

dollar milkshake. So so I

1:04:04

so I started gaining this awareness

1:04:07

of the the

1:04:10

inequality of outcomes due

1:04:12

to financial results, financial

1:04:15

settings. Now, I believe that,

1:04:17

you know, if you work harder, and then

1:04:19

someone then the next guy or the next

1:04:22

gal, then you should benefit from

1:04:24

that. But this felt wrong to me that just

1:04:26

because of where I was born, I somehow had

1:04:28

a leg up or a foot up over

1:04:31

someone else and also at a dysfunctional

1:04:33

others. The other

1:04:35

thing was, I was a geek, I was

1:04:37

into tech from a very, very young age.

1:04:41

I was building neural networks

1:04:43

in secondary school. I

1:04:47

studied computer science and cognitive

1:04:49

science in university. And

1:04:51

I was into tech for most of my career. So 2011

1:04:54

came along. And a number

1:05:00

of people told me about this Bitcoin thing. It

1:05:02

was actually two or three people within a few

1:05:05

weeks of each other mentioned Bitcoin to me.

1:05:07

And they saw it and they immediately thought Ovi would

1:05:10

like this because it was it

1:05:12

both it both hit

1:05:15

my geek muscle because it was this

1:05:18

really cool technology. And

1:05:20

also it was about this new form

1:05:22

of meritocratic money, I would

1:05:24

call it freedom finance, the

1:05:26

way I described it. And so yes, they were

1:05:29

right. I was very interested. I

1:05:31

bought a little. I had

1:05:33

a business at the time that I was focused

1:05:35

on. So I didn't pay

1:05:37

too much attention. But because

1:05:39

I thought this was great technology, but and

1:05:42

the idea and philosophy were amazing. But I

1:05:44

don't know if this is going to

1:05:47

be able to survive against

1:05:49

the all powerful states and

1:05:51

so on. Two

1:05:54

years went by 2013 and

1:05:57

my soon to be co founder of my

1:05:59

previous company. the exchange came

1:06:01

up to me and suggested

1:06:04

that look there's this Bitcoin thing he'd

1:06:07

recently got into it and

1:06:10

maybe we should set up a Bitcoin exchange in

1:06:12

the UK because there weren't any real good ones

1:06:14

at the time and I looked at

1:06:16

Bitcoin is it still around I looked at it and it

1:06:18

was now worth a lot more than

1:06:20

when I bought in 2011 and

1:06:24

it was still around so you still have this

1:06:26

incredible idea um incredible

1:06:29

technology incredible philosophy and

1:06:31

it had staying power it had anti-fragility which

1:06:34

was the thing that I hadn't seen before

1:06:36

and I thought okay well let's give it

1:06:38

a go there was a very at

1:06:40

that point it was really easy to set up a

1:06:42

Bitcoin exchange you just had to not be crooks

1:06:45

and not be corrupt and

1:06:47

so you just said well why don't we just set up an exchange

1:06:50

and we'll just run it well uh

1:06:52

and that's it we serve

1:06:54

this exchange it went on to be the

1:06:57

UK's longest running Bitcoin exchange

1:07:00

we were the first um to

1:07:02

do something called proof of reserves

1:07:04

cryptographic proof of reserves um and

1:07:07

we had an unbroken record from

1:07:09

the beginning of the of the

1:07:11

exchange for eight years doing monthly

1:07:13

audits of our reserves and

1:07:15

trying to name and shame other

1:07:17

exchanges to say why they

1:07:19

why we as a you know small

1:07:21

to medium size at the end a

1:07:23

medium size exchange could could manage this

1:07:25

whereas these very large exchanges seem to

1:07:28

give continue give excuses why it was

1:07:30

so difficult for them to do

1:07:32

um and so we we

1:07:35

eventually sold the exchange but

1:07:38

as I said as time went on I became

1:07:40

clearer and clearer and clearer to me that

1:07:44

we were failing

1:07:46

in our ability to get people

1:07:48

to self-custody we literally unlike most

1:07:50

exchanges the incentives are for you

1:07:52

to not make people self-custody so

1:07:55

you'll say that you're interested in it but you

1:07:57

pay lip service to it a few That

1:10:00

just might be something that could get a

1:10:03

number of these people who want self custody,

1:10:08

but off exchanges and start that

1:10:10

journey towards self custody. That

1:10:12

was a nub of the idea. Obviously, the

1:10:15

technology that would allow that to happen, I wasn't

1:10:17

aware of at the time, but

1:10:19

little did I know that about

1:10:21

a year or two later after I

1:10:23

sold my exchange and was looking at

1:10:25

was at hackers Congress that I met

1:10:28

Eric and he explained Fedi Mint and

1:10:30

I realized this was the technology that

1:10:32

could provide an experience that was better,

1:10:34

more private, more scalable, but user experience

1:10:36

is actually easier than the user experience

1:10:39

of using an exchange.

1:10:42

To join an exchange, you have to fill in

1:10:44

lots of forms and scan different

1:10:46

things, etc. It can take a while

1:10:49

to use a Fedi Mint, you scan a

1:10:51

QR code and you're signed up. No

1:10:55

emails, no phone numbers, and so on,

1:10:57

instantly in there and the people that

1:10:59

you trust the most and

1:11:01

that care about you the most are

1:11:04

the ones who are custody for you. I'm

1:11:07

really excited about that. It doesn't

1:11:09

obviate the need for exchanges. For

1:11:11

some people, they may trust a

1:11:14

stranger, a curly head guy in the Bahamas more

1:11:17

than they trust their friends and family.

1:11:20

Other people will and many

1:11:22

people will and should trust

1:11:25

themselves more than other people

1:11:27

who are not there. There's

1:11:30

options for all, but this is,

1:11:32

I think, a really interesting addition

1:11:34

to that space of

1:11:37

custodial options. Yeah, absolutely.

1:11:40

I think you're correct. Pawal

1:11:44

has a question for you. Is

1:11:46

there an economic incentive for guardians to run

1:11:48

the Mint? Is it run like a profitable

1:11:50

business or is it like a nonprofit organization?

1:11:52

How do you see this unfolding? It

1:11:59

can be. run as

1:12:02

with an economic incentive that is possible.

1:12:06

And actually there needs

1:12:08

to be a very small fee, maybe

1:12:10

one SAP per note

1:12:12

potentially for any public

1:12:14

federation. If it's public, you are

1:12:17

open to the potential for

1:12:19

DDoS where

1:12:23

people can just mint and redeem and

1:12:25

not do anything with it. So

1:12:29

charging a small amount,

1:12:31

proof of work effectively,

1:12:34

Bitcoin and SAT so effectively, quantize

1:12:37

proof of work. You can

1:12:39

charge a small amount or there are alternatives

1:12:43

that our FedIment protocol are working

1:12:45

on where instead of charging money,

1:12:48

you can force them to perform a proof

1:12:50

of work task to receive. So

1:12:52

you can choose, they can either perform some work

1:12:55

or they can pay a SAT. But

1:12:59

that will mean there's even

1:13:01

in that case a small revenue amount, but that

1:13:03

would just basically cover costs. But you could choose

1:13:05

to increase that so it's a fee. But

1:13:08

the option that we recommend

1:13:11

for communities or families is

1:13:14

to not use financial capital but social

1:13:16

capital, i.e. you don't charge for the

1:13:18

service, but it's relatively inexpensive

1:13:20

to run. A

1:13:23

federation could

1:13:25

be run on four Raspberry Pis and you could

1:13:27

pick up a Raspberry Pi for under $50 and

1:13:30

it uses a very

1:13:32

small amount of internet

1:13:35

bandwidth, minimal, and

1:13:37

a very small amount of electricity it can run on a USB chip.

1:13:42

So you're talking about internet bandwidth

1:13:44

requirements of a smartwatch and

1:13:46

the cost will be $50. So

1:13:49

it's near to free to

1:13:51

run. But

1:13:54

you are gaining the social capital of supporting and helping

1:13:56

your friends and family, which in the end... And

1:14:00

you may already be doing as an Uncle

1:14:02

Jim, if they're asking you,

1:14:04

if you have your, if someone is holding

1:14:06

Bitcoin and then they have their

1:14:08

private keys and they are giving it to a

1:14:10

friend or family to have a backup of their

1:14:12

keys, that person is also the custodian of their

1:14:15

keys already. And they do that for free, but

1:14:17

that person, they are trusting not to run off

1:14:19

with their keys. And if they split

1:14:21

it up between two or three friends or family, well,

1:14:24

those two or three friends could collude. So

1:14:27

you have the same challenge already. And

1:14:31

people are doing that regularly around the world

1:14:33

for free. The other benefit is

1:14:36

economies of scale. You,

1:14:39

if you're self-custodying your

1:14:41

own Bitcoin and you're using

1:14:43

Lightning and you're in a

1:14:45

self-custodial way, you're going to

1:14:47

incur costs for channel rebalancing,

1:14:51

opening channels, closing channels, for

1:14:54

manage, for buying hardware wallets and so

1:14:56

on and managing your keys. There's

1:14:58

a cost to do that. If you have

1:15:01

a Fedi-ment, then those costs can be

1:15:03

amortized across your family or community.

1:15:05

So if it's a community of a thousand people and

1:15:08

you amortize those costs equally,

1:15:10

then your costs for

1:15:13

running an operating Lightning node and

1:15:16

self-custodial get divided by

1:15:18

a thousand. Let's

1:15:20

say instead of one, you have four

1:15:22

people in the mint, then it gets

1:15:24

multiplied by four, divided by thousand. It's

1:15:26

still a 250, one over

1:15:28

250 X of the costs. So if it was

1:15:30

costing you $50 a

1:15:32

month, it's now costing you 20 cents

1:15:35

a month. So

1:15:38

that's the other benefit that you save the cost

1:15:40

because you're sharing the costs across people. Excellent.

1:15:43

All right. Anything

1:15:47

else you want to tell us about Fedi? Well,

1:15:50

about Fedi, I said we

1:15:53

are working on getting

1:15:56

to the point where we're fully going to

1:15:58

release. We had Fedi Alpha. When

1:20:01

you, one of the key challenges

1:20:03

with Bitcoin

1:20:05

for people who are less

1:20:07

sophisticated, so on is even people

1:20:09

who are sophisticated, how do I back

1:20:11

up the keys for my

1:20:14

Bitcoin or for my money? And

1:20:18

often it comes down to you get 12 or 24 words.

1:20:22

12 is currently quite common

1:20:25

words that you have to remember and

1:20:28

so on. But then the question is, well, what do I

1:20:30

do with those 12 words? Where do I store those safely?

1:20:34

If I give it to my partner

1:20:37

or a friend, how do I know they don't just

1:20:39

stick it on a fridge magnet on their

1:20:41

fridge? My security becomes

1:20:43

the lowest common denominator amongst the security

1:20:45

of the friends who are backed up

1:20:47

my keys. I could be keeping mining

1:20:50

in Fort Knox, but if

1:20:52

my friend has a backup and they

1:20:54

keep it under their pillow, then

1:20:56

I haven't got very high security. So

1:21:01

that's the norm. And we

1:21:03

support the norm backup where you can

1:21:06

take the keys and recover all your

1:21:08

e-cash with 12 words. However,

1:21:10

we have another option. Because

1:21:12

you have communities that you're a part of, you

1:21:15

can leverage the power of your community to help

1:21:18

back up your keys. So

1:21:20

because remember, these are people that you're already trusting with

1:21:22

some of your Bitcoin anyway.

1:21:26

And the way this will work is that

1:21:30

you can take your

1:21:32

12 words and cryptographically

1:21:37

break it up into parts where

1:21:39

each part cannot be used

1:21:41

to determine any of the words. But

1:21:43

if you take enough together, you can

1:21:45

reconstitute your words. You

1:21:47

can then pass those different parts

1:21:50

to the different guardians and

1:21:53

they will store those

1:21:56

parts locally. Now, there's

1:21:59

a little bit more to that to be done. make it

1:22:01

really simple. All we ask the users to do is

1:22:03

record a video of them saying the words

1:22:05

FEDI. It's a two

1:22:08

second video. That video isn't actually

1:22:10

sent to the guardians. So

1:22:13

the guardians don't get to see the video.

1:22:15

But in the video, a

1:22:18

fingerprint of that video is

1:22:21

attached to the

1:22:23

passwords and the passwords are encrypted as

1:22:25

well. So even though the guardians are

1:22:27

holding the passwords for you, it

1:22:30

splits up across them and they don't know

1:22:32

who they're holding it for. And

1:22:34

they can't decrypt it. And you're

1:22:36

left with a file which contains your video

1:22:38

of you saying the word FEDI and

1:22:41

this password. And it's all stored. And this all happens

1:22:43

with a click of a button. You say FEDI and

1:22:45

it out pops this file and the

1:22:47

backup of your keys are stored. Now that

1:22:49

file doesn't contain your password,

1:22:52

but it contains the key to unlock

1:22:54

your password. So you can store that

1:22:58

anywhere you want. You could send it to

1:23:00

yourself by email. You could send it to

1:23:02

some friends anywhere. Now,

1:23:05

fast forward a year and

1:23:08

you lose your phone and you want to recover. With

1:23:10

social backup, you find this file

1:23:13

and you download the FEDI app

1:23:16

and then you will initiate

1:23:19

social recovery. And

1:23:22

what it will do is say, well, upload this

1:23:24

file. It will upload the file. It

1:23:26

will then use the

1:23:29

image in the video to send to the

1:23:31

different guardians. And by the

1:23:33

way, this all happens automatically. The actual guardians don't

1:23:35

have to do anything here. They're just sleeping or

1:23:37

chilling. And

1:23:40

the guardians can then compare the video with you.

1:23:42

You walk up to them and say, I want

1:23:44

to recover my keys. And they say, is this

1:23:46

video of you saying FEDI the same person, the

1:23:48

person in front of me? If

1:23:51

it is, then they will return

1:23:53

their part of your key. You

1:23:56

go up to say free of the four guardians.

1:23:58

And as long as you get enough people. returning

1:24:00

the parts of the key, you can now

1:24:02

recover. So this is a

1:24:04

long explanation, but the user experience is very

1:24:06

simple. I wanna back up my keys, I

1:24:08

record the word FEDI and I'm done. And

1:24:11

I wanna recover, I just go up

1:24:13

to three of the guardians and I just

1:24:15

walk up to them, scan a QR code,

1:24:17

they check that the video, and

1:24:19

that's the first time I've seen a video, matches. And

1:24:22

if they say, yes, it does, I received the

1:24:24

different parts of my key, I

1:24:26

reconstitute my password. And

1:24:29

this actually is quite interesting, again, going

1:24:32

back to AI and deepfakes, I

1:24:36

predict we already saw a new story from

1:24:38

a few months ago where a

1:24:40

bank, I believe it was a bank, lost

1:24:43

20 million because they went on

1:24:45

a video call and there

1:24:47

was a deepfake of one of

1:24:49

the junior employees asking the senior

1:24:51

team to release an

1:24:53

amount of money. And, but it was AI

1:24:55

generated. We're

1:24:59

entering a world where the standard

1:25:03

processes by which banks

1:25:05

and finance institutions use to recover

1:25:08

your keys or not just banks, any

1:25:12

organization, Facebook, Microsoft and

1:25:14

so on, involves at

1:25:17

some point when they're in doubt, involves

1:25:19

getting onto a video call and you

1:25:21

showing a passport or a video. Well,

1:25:24

we're gonna get to a point where

1:25:26

those sort of mechanisms are gonna break

1:25:28

down in the face of deepfakes and

1:25:30

AI. And so the

1:25:32

only way you will be able to verify

1:25:34

someone is who they say they are, is

1:25:37

to meet them physically in person. But over

1:25:39

the last decade or so,

1:25:41

we've systematically shut down all local

1:25:43

branch offices and so on. So

1:25:46

those mechanisms don't exist

1:25:48

anymore. So again, just

1:25:52

by incident, because this was invented,

1:25:55

social backup was actually first

1:25:57

implemented before chat GPT. the

1:26:01

original chat GPT came out and everybody started

1:26:03

getting really excited about AI. And

1:26:06

it's been working with communities

1:26:09

with this since before Fedi

1:26:11

Alpha even. But

1:26:13

by coincidence, it happens to be deep

1:26:15

fake proof because until

1:26:17

we have Androids that look and feel

1:26:19

and sound exactly like human beings, you

1:26:23

have the ability to meet someone

1:26:26

in person when you have these

1:26:28

hyper local Fedi Mint communities. Very

1:26:31

nice. All

1:26:33

right. Well, I guess this

1:26:35

is all I have. Anything else you want to tell

1:26:37

us? No, it

1:26:39

was a pleasure. It was

1:26:41

great. Hopefully we'll have some

1:26:44

Korean barbecue again one day soon. But

1:26:47

the only other thing I would say

1:26:49

is just to find out

1:26:51

more about Fedi Mint and eCash

1:26:53

in general, you should go to

1:26:55

fedimint.org to find out more

1:26:58

about Fedi, the company that's one

1:27:00

of the companies working on Fedi

1:27:02

Mint and other protocols. Go

1:27:05

to Fedi, FEDI.X-Y-Z. Excellent.

1:27:08

Yes. And we'll be sure to post these

1:27:10

links on the show notes.

1:27:13

Obi, thank you so much for joining us and for your time. And I really wish you all

1:27:15

the best. Thank you very much. Cheers,

1:27:19

man. Take care. Bye.

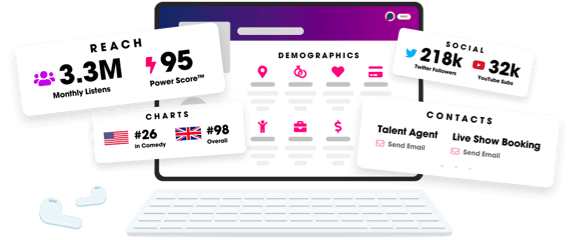

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us