Episodes of Informed Decisions Independent Financial Planning & Money Podcast

Mark All

In this week's podcast, I take a look at lump sum invested vs dollar cost averages €1m in Ireland. Key topic points: Pros and cons of Lump Sum Investing and Dollar Cost Averaging A 'look-back' to see which has been most profitable for €1m i

In this week's podcast we have a fantastic, informative chat with awarding winning, international expat tax advisor, KPMG chartered accountant, and tax specialist, Stephanie Wickham. Key topics include: Responsibilities for US Citizens living

In this week's podcast I talk about Guardrails for Irish retirees. One of the big questions I hear from clients heading into their 'next chapter' (blissful retirement!) is: how much can I actually spend each year without running out of money?

This week I share a short piece with you to help prepare for relevant (potential) changes in the upcoming Budget. What we'll all want to avoid is seeing a change come into effect that we could have seen coming, and that we could regret not hav

In this week's podcast we talk about what’s happening with bonds and why you should care. Over the past two years, we've seen dramatic shifts in the bond markets. Lots of investors and pension holders in Ireland have often large swathes of Bond

In this week's podcast, I cover a topic that I did a couple of years ago. FET is still an issue that I believe awareness is still not as wide as it should be. Potential Federal Estate Tax (FET) on US-based assets is critical for for us all to

This week's podcast was a difficult one to do, and I'm still not sure if it's appropriate or not for this space, but my intent is to look for the positives, and to be reminded of a few key principles, financial and non-financial. I hope it help

For those looking to pass on wealth while trying to simultaneously reduce tax on the proceeds, Section 73 investment plans offer a potential solution. These plans are specifically designed and sold to try manage Capital Acquisitions Tax (CAT) l

In this weeks podcast we have a interesting guest with us - Alan Purcell from Cloud Accounts in Dublin. Alan is unique as he is both a Chartered Accountant and Chartered Tax Advisor. We had a quite broad conversation and covered a lot of ground

For this week's podcast we welcome a fantastic guest, Chet Bennetts. A professor of Financial Planning with a wonderful story about how he got to where he is and shares some interesting ideas with us. Main topics: Chet's journey to financi

This week's podcast is the 300th Informed Decisions Personal Finance Podcast, so it is a little bit different than the usual! Key topics are: Inflation vs Investments over the past few years, what has or has not retained your purchasing power

In this week's podcast I take a look at Section 72 policies. What are they and what's good and bad about them? What would the outcome look like if you saved the premium instead? Section 72 policies are often discussed as a tool to manage inheri

In this week's podcast I tackle a topic that's been heavily addressed already, inflation - but in the context of what it means for your pension assets. You may have noticed the Consumer Price Index (CPI) suggesting that inflation rates are easi

In this week's podcast I take a look at Bonds If you've got a slice of your pension or investment pie in bonds—be it individual or a fund, government or corporate—you're in good company. Many savvy investors do, and have always done. It's alway

In this week's podcast, I take another look at Lifestyle and Default Investment strategies for pension funds in Ireland. Something I've discussed before. For the past 7 years, I have been making the case for avoiding Lifestyling for most invest

In this week's podcast, I talk about Larry Fink, Warren Buffet, and my granny's kitchen. Larry Fink is renowned for his role as the CEO of BlackRock, one of the world's largest investment management firms. Much like Warren Buffett, Fink has ear

In this week's podcast, I talk about the Wealth of Health. Something slightly off-topic this week, and something far more concise that usual. I hope it helps you. A definition of wealth is 'a plentiful supply of a particular desirable thing'.

In this week's podcast I take a look at Fisher Investments Ireland. Fisher Investments have been around the USA a long time apparently, and recently set-up shop in Ireland, but are Fisher Investments Ireland any good, I hear some ask? Are they

One of my favourite podcasts is The Compound & Friends featuring hosts Josh Brown and Michael Batnick of 'Ritholtz Wealth' in the US. They are irreverent, funny, informative and between them and their varied guests (they call them 'friends'!)

In this week's podcast I talk about the scandal of UK investment firm Saint James' Place. It is a monstrous financial advice and investment firm regulated by the FCA in the UK. It has been marred by scandals over the past few years. They've bee

In this week's podcast we talk about Retirement Investment: The Case for Equity Over Bonds. Research published in October 2023 suggests a significant shift in retirement investment strategies is merited. The research indicates that retirees oft

In this week's podcast I talk about S&P500 and if it's a good idea or not to go All-In. Should you bet all your investment or pension assets on the good 'ol S&P500? Or would you be considered 'bananas' to do so?!? As with a lot of my podcasts,

Pension Lifestyling in Ireland is rampant. By my reckoning, the vast majority of people with pensions are invested in insurance company pension schemes using 'Pension Lifestyling'. This week I explore if that is a prudent approach for you as a

In this week's podcast Paddy has a fantastic chat with Anne Lester. Anne Lester is a retirement expert, author, media commentator, top-rated speaker and former Head of Retirement Solutions for JPMorgan Asset Management, where she worked almos

Something a little different, and a lot shorter this week. Far too often, when a prospective client asks me to run the rule over their financial affairs, I see complexity and sophistication, and resultant negative outcomes. It is not their faul

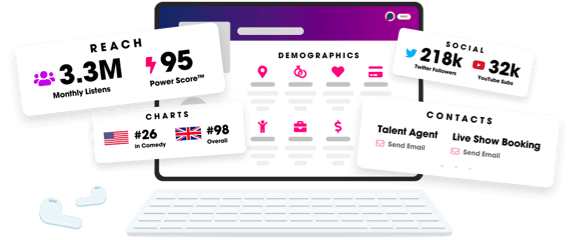

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us