Episode Transcript

Transcripts are displayed as originally observed. Some content, including advertisements may have changed.

Use Ctrl + F to search

0:04

Welcome to Goldman Sachs Exchanges, Great

0:06

Investors. I'm Alison Mass, Chairman of

0:08

Investment Banking within Goldman Sachs' global

0:10

banking and markets business and your

0:12

host for today's episode. Today, I'm

0:14

thrilled to be sitting down with

0:16

Mike Aragheti, the co-founder and

0:19

CEO of Aries Management. Aries

0:21

is one of the world's largest and most

0:23

respected alternative asset managers with more than $400

0:26

billion in assets under management

0:29

and a market cap of over

0:31

$40 billion. Aries is a top

0:33

player in real estate, private equity,

0:35

secondaries, and many other businesses. But

0:38

what really makes them stand out is

0:40

their prowess in private credit. Aries is

0:42

one of the biggest direct lenders in

0:44

the world, and that's no accident. Today,

0:46

I'm so excited to find out how

0:48

Mike built up that business and where

0:51

he thinks this red hot asset class

0:53

is going next. So, Mike, welcome

0:55

to the program. I'm so happy to be here. Thank you. So,

0:57

let's start right at the beginning. You

0:59

graduated from Yale, where you majored

1:01

in ethics, politics, and economics, then

1:04

went on to a storied investment

1:06

bank called Kitter Peabody, which

1:09

I'm probably one of the few people left on Wall

1:11

Street who knows what that is. So, what

1:13

attracted you to a career in finance and

1:15

do you have any memories from that first

1:17

job? Yeah, it's so funny because now

1:20

that I have a college-age son and watching

1:22

him go through his own process, you

1:25

realize just how little you really know

1:27

when you get out of college. I

1:29

always had an entrepreneurial bent, like a

1:31

desire to build businesses, but I didn't

1:33

really know what a career in finance

1:35

would mean. Candidly, I graduated early in

1:38

three years, and I had

1:40

no friends around me that were actually going

1:42

through the job process. So, luckily, someone who

1:44

I was friends with the year prior to

1:46

me got me this job at Kitter Peabody.

1:49

Sounded pretty cool. The pay was good. I think it was $26,000

1:51

back then, which

1:53

was quite exciting. And I went

1:55

for it, and the rest

1:57

is history. The funny thing is now, here

2:00

running Aries and talking about

2:02

culture and the younger generation.

2:05

The memory I had was just I don't think I've ever

2:07

worked that hard. I don't know if I ever will. I

2:09

know that you know this, but it was 100 plus

2:12

hour weeks constantly. My

2:14

first apartment was across the street from

2:16

the office. So Kidder P. Body was

2:19

a bad. But

2:21

that was how I said I'm going to cope.

2:23

So it was 10 hundred square. My apartment was

2:25

300 square. So I

2:28

lived for two years in this hundred yard

2:31

radius. But the reason it was a

2:33

good memory is to have a bed

2:35

that close to the office proved to

2:37

be quite the asset for the entire

2:39

group of analysts and associates there. So

2:41

it's like that movie, The Apartment, where

2:43

everyone has a key to Mike's apartment.

2:45

But it was an incredible training ground

2:47

and just the discipline and the work

2:49

ethic and the attention to detail. It

2:51

was a great foundation for me. Yeah.

2:53

Did you grow up in New York? I grew up in New

2:55

York. I was in the suburbs. So I was familiar with the

2:58

city, but I don't know why I chose it. It went kind

3:00

of over square back then. Literally

3:02

if I had to go grocery shopping, I had to get on

3:04

the subway and go to 14th Street. I

3:06

remember that. I remember that. I

3:09

did the opposite. Like when

3:11

I started down at Drexel in 1981, I

3:13

decided to do exactly the opposite. I got

3:15

an apartment on the Upper West Side under

3:17

the theory that even if I went home

3:19

at two in the morning, I would at

3:21

least see the city on my ride home

3:23

and my ride back home

3:25

would maybe pass Lincoln Center or something that would give me

3:27

some joy. You'd probably pass that in the back of the

3:29

car and miss it anyway. I'm sure I did many nights,

3:31

but I had the exact opposite view because my dad had

3:33

said, you should get an apartment downtown because it will be

3:36

easy. But I took a different tact. But I liked the

3:38

$24,000 a year. Actually

3:40

fun fact, Ken Mollis and I started the same

3:42

year at Drexel, $36,000 a year. And

3:46

I was shocked that somebody was willing to

3:48

pay me that much money. Yeah, that's incredible.

3:50

Yeah. All right. So back

3:52

to your career. Aries in 2004. So

3:55

the short answer is Bennett Rosenthal and

3:58

back to the whole Drexel connection. I

4:01

left Kitter with a bunch of Drexel

4:03

alums to go to a place called

4:05

Indosuez Capital, which if you actually look

4:07

at who was there and what we

4:09

were doing, a lot of folks that

4:11

are now actually prominent in private credit

4:13

did some time there, including my current

4:15

partners at Run Credit. And we were

4:17

very early partnering with a French bank

4:20

to make middle market loans to private

4:22

equity firms, but in a way that

4:24

feels a lot like the business now.

4:27

And in 1997,

4:30

we were looking to expand and we

4:32

interviewed Bennett, my now very close friend

4:35

and partner, because he had worked for

4:37

Les Lieberman as an associate at Drexel.

4:40

And I was working for Les at the time. And

4:42

so we snipped each other out a little bit.

4:44

And then ultimately Bennett chose to move

4:47

to LA and go work at Apollo and

4:49

then ultimately spun out Aries. And he called

4:51

me in 2003 to say,

4:53

hey, we're building this thing and we

4:55

see this opportunity in private credit. Do

4:57

you want to join? And it just

4:59

so happens that we had spun out

5:01

of yet another bank. We

5:04

had a portfolio of assets. We had a team

5:06

of about 15 people. And so we joined forces

5:08

and the rest is history. Yeah, I never knew

5:10

that story about Bennett. Well, Bennett likes to joke.

5:13

You had two New Yorkers, fairly young at the

5:15

time. Hair gel was still a thing.

5:18

We were sizing each other up. And the way he tells

5:20

it is I'm sitting there, I'm looking at this young guy

5:22

with the slick back hair. And I'm like,

5:24

I really like this guy, but I don't know. And

5:27

I tell him I was thinking the exact same

5:29

thing when I met him. So it was that

5:31

careers are all about the people that you encounter

5:33

and those relationships. And Bennett obviously had good vision

5:36

to understand the opportunity. But obviously we trusted each

5:38

other. And so it was a big move for

5:40

him. And it was a big move for us,

5:42

too. All right. So has

5:44

Aries always been a player in direct lending? Can

5:46

you give us some of the history there? So

5:49

the answer is yes. The firm actually

5:51

got its start managing market value CLOs,

5:54

which again, people don't talk a lot

5:56

about, but probably the worst investment vehicle

5:59

ever invented. just in the sense of

6:01

the mark to market and the asset

6:03

liability mismatch. But what was great about

6:05

it was it gave you the flexibility

6:08

to invest in liquid credit, illiquid credit,

6:10

equities, etc. So I think one of

6:13

the reasons that we are as well

6:15

positioned as we are today is our

6:17

first funds were go anywhere investment vehicles.

6:20

And the earliest partners and teams

6:22

were investing in equities, bonds

6:25

and loans, CLO securities

6:27

and mezzanine, which in

6:29

the early days of private credit was

6:31

how a non-bank would participate in the

6:33

mezzanine business. And the way

6:36

that we came together with Bennett at

6:38

the time was we were sourcing a

6:40

ton of private credit at the time and

6:42

were effectively partnering with those early vehicles

6:44

on these mezzanine investments. So there was an

6:46

understanding of that business. But I think

6:48

even in the early days, and this

6:50

is where some of the early mover advantage

6:53

came in, most people were still wired

6:55

to the capital markets. They were coming

6:57

at the illiquid credit market from the perspective

6:59

of the loan and bond market or

7:01

the private equity market where you were the

7:03

client. So you would sit around, you

7:05

wait for the phone to ring, someone

7:07

would show you the deal, you'd evaluate it.

7:10

And we were trained through our banking

7:12

background to go out and really source

7:15

and originate. So yeah, Aries

7:17

has always been buying private credit. But I

7:20

think the big pivot for us is

7:22

when we decided to really invest,

7:24

grow the BDC was that early

7:26

emphasis on going out and sourcing

7:29

and really creating our own flow.

7:32

So for our listeners, I want to

7:34

ask a really basic question. What does

7:36

it really mean to run a direct

7:38

lending business? I think our listeners will

7:40

be familiar with the basic idea. You

7:42

raise money from investors, you use that

7:44

money to make loans to businesses, which

7:46

they hopefully repay with interest. But how

7:48

does that business function on a day-to-day

7:50

basis? And where is the value really

7:52

created? It's a great question because it's

7:54

a very simple business as you articulate it that way.

7:56

But it's complicated because in order to do it, we're

7:58

going to have to do it. Well, you have to

8:01

do it at scale. You have

8:03

to do it repeatedly. And

8:05

it seems easier than it is. Because if

8:07

you think about credit generally, it's great when

8:10

it works. But the problem with the asset

8:12

class is if you do everything right, you

8:14

get your coupon. And if you're wrong,

8:16

you can actually lose all your money. And

8:18

so it is, from an asymmetric risk standpoint,

8:21

it's probably a pretty bad asset class. So

8:23

the goal in direct

8:25

lending is not to lose

8:27

money while continuing to capture excess

8:29

return. And so the way that you

8:31

have to think about building value is

8:33

you have to create broad origination networks

8:36

in local markets so that you can

8:38

get to deals before other people see

8:40

them. And you have to surround those

8:43

deals with flexible capital, scaled

8:45

capital, and real client service. Because

8:48

ultimately, the reason that people are

8:50

borrowing in the private market, they're

8:52

getting some creativity and structure or

8:54

terms for some innovation

8:56

around your ability to grow with them

8:58

and support their business plan that they're

9:00

not getting somewhere else. And

9:02

so I think we learned early that

9:04

the tip of the spear for value

9:06

creation is origination. And that sounds so

9:09

simple, but it's really hard to do.

9:11

And the reason it's hard to do is we say no to our clients 95% of

9:16

the time. And when you're trained in banking,

9:18

you try to say yes to your clients 95%

9:20

of the time. And

9:23

pivoting to the point where we can actually

9:25

be a real valued partner to our clients

9:27

but not get to yes all the time

9:30

takes some getting used to. And you have to

9:32

build trust over decades, not years,

9:35

decades, where you're supporting people and

9:37

helping them make money and going

9:39

through bad situations, et cetera. So

9:41

origination's important relationship is key.

9:43

And I think that's key in all

9:45

of our businesses. But when people used

9:47

to say relationship lending, we

9:49

would cringe because that just means you're

9:52

mispricing risk, right? Now when

9:54

we talk about relationship lending, it's really through

9:56

the lens of people have choices. They choose

9:58

to do business with the people. that

10:00

they trust and that are aligned to whatever

10:02

their vision is and that's not easy to

10:04

build. And then I think you really have

10:07

to think about these markets as evolving, right?

10:09

You have to be constantly innovating around the

10:11

service and the product that you deliver to

10:13

your client. There were a lot of folks

10:15

that started in the business when we did

10:17

who were very anchored in mezzanine because that's

10:20

what was available. And when the market started

10:22

to innovate around things like unitronches,

10:24

right? Or even covenant light, you could

10:26

get anchored on the old way of

10:29

doing things, but today, private credit is

10:31

not just lending money to middle market

10:33

companies, it's lending money to

10:36

infrastructure projects and real estate assets

10:38

and structured credit and partnering with

10:41

banks on balance sheet solutions. So

10:43

it's become this whole new pillar in the

10:46

capital markets. It's actually a pretty, pretty exciting

10:48

place to be. So I want

10:50

to get back to innovating later because Aries is

10:52

certainly at the forefront of innovating in your industry.

10:54

But before I do that, I want to talk

10:56

about you as a leader, you

10:59

became CEO at the start of 2018,

11:01

taking over from Tony Ressler. So I

11:03

want to understand what that transition was

11:05

like at the Aries level in terms

11:07

of the company. But as importantly, what

11:09

was it like for you personally? And

11:12

did you feel like you had to change

11:15

from being more of an investor to a

11:17

leader? It's a great question. So

11:19

I was fortunate when I took the job

11:21

in 2018, I had been the president and

11:25

CEO of Aries for six years prior. So

11:28

I had already gotten a lot of

11:30

reps in running the company. And

11:33

a lot of the growth that we enjoyed

11:35

and the diversification globally came through the credit

11:37

side of the business. So I felt connected

11:39

to a lot of the parts of the

11:41

business when I took that role. That

11:43

said, it's almost like when you get married,

11:45

things change. I was with my wife for

11:48

10 years and you say to yourself, we're going

11:50

to get married, it's going to be the same.

11:53

But when you do, it's serious. Things matter more.

11:55

They have consequences. And so I did experience the

11:58

transition from CEO and president.

12:00

president to CEO as a

12:02

deeper sense of responsibility and a more

12:04

profound sense of service to the

12:06

teams and the company. And that was pretty

12:09

energizing. It is a tough transition because if

12:11

you grow up your whole life in the

12:13

deal business, you get into a rhythm of

12:16

just transacting and it's really

12:18

energizing. Closing deals is incredible.

12:21

And we all get hooked on it. And when

12:23

you stop doing that, you have to find the

12:25

way to scratch that itch. So I'd

12:27

like to think one of the reasons why

12:29

we're so growthy in the way that we

12:31

approach our business is because I've effectively looked

12:33

at Aries Management as my deal. I want

12:36

to invest in it the same

12:38

way I used to invest in businesses, but

12:40

do it all in one place. So I've

12:42

been able to find whether it's through M&A

12:44

or new product development to go back to

12:46

my roots on the investing side because that's

12:49

why I got into the business in the

12:51

first place. But it's a tough transition and

12:53

the cadence of business is different too. We

12:55

don't get the immediate gratification. Right. It's longer

12:57

term. Strategic focus. Private equity folks,

13:00

and I say this lovingly and with

13:02

a lot of self-awareness, we're great at telling

13:04

other people how to do succession, but we're

13:06

usually pretty bad at it ourselves. I mean,

13:09

we're kind of experts in organizational design, but

13:11

we're usually pretty bad at shining the light

13:13

on ourselves. And I think as we and

13:15

others in our industry have matured, we've gotten

13:18

much more professionalized and institutionalized in the way

13:20

that we think about things. But the one

13:22

thing we knew was that

13:24

any good succession requires forethought and

13:26

planning and a lot of trust,

13:29

but it also requires the person

13:31

who is vacating the seat to actually

13:34

make room. And Tony,

13:36

I think better than anybody,

13:38

understood that. And his

13:40

transition was probably harder than mine, right?

13:42

To go from a CEO to a

13:44

chairman and really allow for decisions to

13:46

be getting made and to trust those.

13:49

But he did what he was supposed to do

13:51

and gave me a lot of runway and a

13:53

lot of leeway and a lot of support. And

13:55

I think it's a really good example of what

13:57

good succession looks like. And I'm hoping that now

13:59

is a pretty cultural lightning rod for the rest

14:01

of the firm to understand how we do it

14:03

in the future. Yeah, sounds like he's

14:05

a great leader in having recognized that. Yeah.

14:07

I'm going to go off the piece for a

14:10

minute and ask you how would you describe

14:12

your leadership style? And if I was here with

14:14

the 10 most senior people at Aries who

14:16

report to you, how would they

14:18

describe your leadership style? I'd like to think of

14:20

myself a little bit as a servant leader. I

14:23

tend to lead from within

14:25

as opposed to from without like

14:27

in the trenches with people. I

14:31

am pretty hands-on but not micromanager

14:33

in the sense that I'm engaged

14:35

and there to help. I'd

14:37

like to think that I'm approaching my leadership with

14:39

a sense of humility, which is empowering to the

14:42

people that work for me because I don't think

14:44

that they perceive me as having

14:46

interest in anything other than supporting their

14:48

growth and success. Our values

14:50

as a company, it's interesting. One of

14:52

them is self-awareness, which I always

14:54

struggled with because sometimes it could sound pretty

14:57

arrogant to say we're self-aware. But what we

14:59

tried to capture with that was an idea

15:01

that we have a willingness to fail and

15:03

not dwell on it, right? And that we've

15:05

built trust with each other that we can

15:07

actually make mistakes so that

15:09

we can move forward. And I think I'm

15:11

a compassionate leader in that sense where I

15:13

think I'm trying to push people outside of

15:15

their comfort zone and doing it in a

15:17

way where they feel supported to go out

15:19

and take those types of risks. And I

15:22

think that mindset around risk-taking and growth has

15:24

been a big part of our success. So

15:26

your recent growth has been really amazing.

15:29

Aries carved out a niche in what's

15:31

become probably the single hottest area in

15:33

finance. I think Forbes called it the

15:35

sexiest business on Wall Street. Okay, you

15:37

can say that. I just call it

15:40

hot. And you've

15:42

done an amazing job of capitalizing on

15:44

the opportunity. So you've always

15:46

had a successful business. But was

15:48

there a specific moment when you

15:50

realized you were onto something much

15:52

bigger? And is there a lesson

15:55

there? Is it more about foresight, about knowing

15:57

where the opportunity is coming from? Or is

15:59

it about capitalizing on it when it comes.

16:02

I think it's both. I think it's both in

16:05

each of our businesses. We

16:07

were religious planners, right? So

16:10

we are annual strategic

16:12

plans and budgets and three and five

16:14

year growth plans. And then what

16:16

we would call moonshot scenarios where if

16:18

X, Y or Z happens, what does

16:21

it mean for us? And so we

16:23

go into each of our

16:25

business builds with a really good roadmap

16:28

for what we think success looks like.

16:30

And that's important, whether you're doing something

16:32

organically or you're doing something inorganically, because

16:34

again, everyone needs to know what success

16:36

looks like in order to celebrate it

16:38

and know when you got there. And

16:40

the planning is a big part of

16:43

it. And then I guess that's the

16:45

foresight and being open to things happening.

16:47

But when you see things opening, you

16:49

have to have a willingness to invest

16:51

behind growth. And that goes back

16:53

to this risk taking because you never really

16:56

know. I can't say that we knew that

16:58

direct lending would grow to be what

17:00

it is today, but we knew what

17:02

it took to be successful. We had

17:04

identified how big we thought these addressable

17:06

markets were. We made the investments.

17:09

If I think about our European direct lending

17:11

business, for example, which is a a

17:13

large market player now, we

17:16

started building teams across the continent in 2006.

17:19

We didn't make money in that business for, you know,

17:22

five or six years. And it's

17:24

hard, especially when you're in a small

17:26

partnership and you're making investments with

17:29

a long payoff to really sustain those.

17:31

And so I think we've always had

17:33

good vision of where we wanted to

17:35

go and an openness to what the

17:37

possibilities were. But I don't think anybody

17:39

in our business, private markets generally could

17:41

ever have really appreciated how large the

17:44

private market opportunity would be with private credit, obviously at

17:46

the top of the list. Yeah, I would

17:48

say the same about the private equity business for those

17:50

of us who were involved in the 80s and 90s.

17:53

I don't think any of us ever could

17:55

have imagined that it would be such an

17:57

important part of the global economy today. Yeah.

17:59

Look, you have to trust your own. instincts

18:02

and filter too. So going back to even

18:04

private credit, private credit has evolved. You know,

18:06

it was fairly cottage. It served a purpose

18:08

in the market supporting private equity firms, but

18:11

it was not very innovative,

18:13

right? It was high rate coupon

18:15

mezzanine with warrants. And

18:18

as the market started to evolve, if you were not

18:20

willing to evolve with it and many weren't, you got

18:22

left behind. So there were a

18:24

lot of people that were early to this.

18:26

But to your point about foresight, but seeing

18:28

the evolution just kind of missed it. And

18:31

so that goes back to that self-awareness point

18:33

of challenge things like could this

18:35

be more where could we grow or is

18:37

the growth inappropriate and don't chase it? There have

18:40

been a number of opportunities that we've looked at

18:42

where we haven't pursued it

18:44

because we just didn't trust it and didn't

18:46

feel like we could bring the competitive advantage

18:48

or insight to a market where we

18:50

would actually win. So part of it is just you

18:53

hone that filter over time with your partners

18:55

and hopefully it gets better. You know, the more

18:57

you do. It's sensible. Yeah. So

19:00

I mentioned Aries incredible growth and much of

19:02

the actual core team has stayed together for

19:04

25 years. So

19:06

how did you keep the band, so

19:09

to speak, together for so long and

19:11

how much do you think keeping that

19:13

core DNA of that team yourself? Kip

19:15

Devere, Mitch Goldstein, Michael Smith was

19:18

a driver of Aries success. I

19:20

think it's the biggest driver of our success.

19:23

And it goes back to my comments

19:25

about Tony. You know, investing is all

19:27

about trust because you're not right all

19:30

the time and you have to defend

19:32

an idea and take real risk behind

19:34

it. And if you're doing it with

19:37

partners, you have to trust one

19:39

another. And trust is hard generally

19:41

as a human. It's hard at

19:43

scale. Right. Back to what kind of leader

19:45

am I or what's the culture? We're

19:48

fortunate that we all grew up in the

19:50

business together. Right. And so when you're best

19:52

friends in the world or your business partners

19:54

and you go through cycles together, it just

19:57

becomes easier to do things. Right.

19:59

There's. There's no second guessing.

20:02

There's no body who's not holding up their

20:05

end of the bargain. Everybody's just running at

20:07

speed together. And so if I go back

20:09

to those early days of

20:11

the smaller partnership, and I would add

20:13

Tony and Benetton, John Kiswick and others

20:15

to that list, deep sense of trust

20:18

emerged. And so the people who are

20:20

partners at Aries now were analysts here

20:22

20 years ago. And

20:24

so they saw that. And they've role

20:26

modeled it and repeated it and replicated it.

20:28

So I do think the culture here is

20:30

a really big driver of our success. And

20:34

unlike others in our business, this is a

20:36

team sport. I think most people who thrive

20:38

at Aries want to be part of a

20:41

team. They want to be part of a team that's

20:43

winning, but doing it together. Whereas

20:45

I think certain investment houses are more about

20:48

who's the star athlete on that team and

20:50

how do they win. And we've tried, because

20:52

of this DNA and this friendship, to not

20:54

let the ego seep into the business. And

20:57

I think that's been a big benefit to

20:59

us. Don't know if it works for everybody,

21:01

but it's definitely worked for us. Well, it

21:03

certainly works here at Goldman. I mean, I

21:05

think the continuity of leadership and the fact

21:07

that our partnership can be, I always say,

21:09

constructively contentious with one another. We get to

21:11

better outcomes. We see that. We

21:13

see that too. So what's also

21:16

amazing is that you have

21:18

grown without sacrificing the culture. And

21:21

as a leader, how do you maintain

21:23

a tight-knit culture as you've grown so

21:25

quickly? It changes over

21:27

time. And this has been part of my own

21:30

evolution as a leader. When you're

21:32

smaller and younger, you don't

21:35

really talk about culture. You just model it.

21:37

Like this is what good culture looks and

21:39

feels like, because you can have a personal

21:41

relationship with most of the people

21:44

in your company. And then as

21:46

you grow, you begin to understand that

21:48

you have to define who you

21:51

are and what you stand for as a company. And

21:54

we've done that where we've basically articulated who

21:56

we are, who we want to be, what

21:58

our mission and values are. and we've tried

22:00

to align people to that. And

22:04

that's been incredibly energizing, productive

22:06

and a big leap forward for

22:08

us because you move away from

22:10

this idea of culture is

22:12

what happens in the office every day to this

22:15

sense of higher purpose and calling, which

22:18

again, done at scale is really powerful.

22:20

So, employees there, as we talk about

22:22

culture and the reason for that is

22:25

great culture can drive out performance,

22:27

right? It can drive out performance

22:30

around the investment committee table. It

22:32

can drive out performance at the company

22:34

level, provide stability and

22:36

frankly, it's just a better work

22:39

environment. You retain talent, people feel

22:41

more fulfilled. So, we talk about

22:43

cultural a lot and

22:46

it's so interesting now because we've gotten so

22:48

global and so diverse, but the culture has

22:50

gotten stronger because we're just finding interesting people

22:52

from all walks of life and all over

22:55

the globe that are aligning to our values.

22:57

And so, the conversation for us always comes back

23:00

to service and values and understanding why

23:02

we come to work every day, not just what

23:04

do we do for work and it's

23:06

working, but it's hard. At scale, it's really hard.

23:08

You have to really work at it and

23:10

you have to be willing to adjust it too, right?

23:13

I think we have found what worked 10 years ago

23:15

doesn't work now and I'm pretty sure 10 years from

23:17

now, we're going to have to do different

23:19

things to make sure that the culture stays intact,

23:22

but it's been a blessing so far. Have

23:24

you ever read those books, Seven Habits

23:26

of Highly Effective People? And there's one,

23:29

Seven Habits of Highly Effective Families. Somebody

23:31

should probably write one, Seven Habits of

23:33

Highly Effective Companies. But if you read

23:35

those books, they talk about having a

23:38

moral-based or character-based or value-based

23:40

home or center and then

23:42

every decision you make comes

23:44

from that and therefore,

23:46

it's very sensible and thoughtful. Yeah,

23:49

and I think people pay us to generate

23:51

investment returns. So that is what we do

23:53

for a living, but what we try to

23:55

talk about, which makes it very powerful, is

23:57

you think about who benefits from our investment

24:00

returns. returns. We manage money for state

24:02

pension plans and insurance companies and

24:04

retirement portfolios. Like when you really

24:06

drill down the tens

24:08

of millions of lives that are dependent on

24:11

our returns, that changes the game, right? Now

24:13

you're not just showing up and saying, how

24:15

do I generate return and promote? You're saying,

24:17

how do I actually not mess this up?

24:20

Because I've got 20 million people who are

24:22

relying on me doing my job. And so

24:25

we have created a real sense of responsibility

24:27

at the company that I think

24:29

is pretty unique in our business. So I'm

24:31

curious for your view on the outlook for

24:33

direct lending given the current economic cycle. To

24:35

a lot of people, the asset class seemed

24:37

to almost come out of nowhere in the

24:39

past few years. But of course, it's been

24:42

around a long time and Aries knows that.

24:44

But where do you think it's going next?

24:46

There's a scientific term, I'm not gonna remember the

24:49

name for it, but I will ping you after

24:51

this conversation, which is the term

24:53

to describe when you see something

24:55

that you haven't seen before that's been there all

24:57

along, you can't stop seeing it. It's like ocular

24:59

or something. And I only mentioned that because in

25:01

every other part of your life, it happens to

25:04

you every day. Like you see something on the

25:06

street that's been there for 20 years and you

25:08

never noticed it before you walk by it and

25:10

all of a sudden, you can't stop looking at

25:12

it. That's what's happening in direct lending right now.

25:14

This is a market that has been here

25:17

for 30 years. And it's been

25:19

just chugging away. And interestingly, when you

25:21

look at the growth of private credit,

25:23

it's grown a little less than 15%

25:26

compound for the last 10 years. Guess

25:28

what? So has private equity grown 15%. The loan

25:31

and high yield market have grown in the low double

25:33

digits. The reason I think private

25:35

credit is being perceived as growing

25:38

faster is it's just a straight line compounder. So

25:41

there's no ups or downs. You don't have an

25:43

up 30, a down 20, there's no draw downs.

25:45

And so it just keeps clipping

25:47

away at 10 to 15%. And

25:50

then all of a sudden, the numbers

25:52

get pretty large, but there's nothing to

25:54

evidence that it's grown disproportionate to other

25:57

parts of the capital markets, which is how we get

25:59

recentered. on are people

26:01

taking inappropriate risks or what's

26:04

the right pricing for the risk that we're

26:06

taking. And so I think direct lending and

26:08

private credit still have a long, long way

26:11

to go. There are structural

26:13

things at play just in terms

26:15

of the aging of the population

26:18

and people's desire for dependable yield

26:20

that's creating demand for private credit.

26:22

The private equity ecosystem continues to

26:24

grow and expand. That's creating demand

26:26

for private credit. The loan

26:28

and high yield markets continue to move to scale

26:31

and they're servicing ever larger borrowers.

26:33

That's creating demand. Commercial

26:35

banks around the globe are dealing with

26:38

new regulatory capital frameworks and particularly in

26:40

this rate environment. That's seeing

26:42

transition of assets. So there's a lot of

26:44

just secular tailwinds for direct lending. Putting aside

26:47

the globalization, which is one of the things

26:49

that excites me the most because when I

26:51

look at what we've been able to do

26:53

in Europe in the last 15 years, what

26:57

we're building in the Asia Pacific

26:59

markets, these private credit themes

27:01

are in place in those markets, but

27:03

the markets aren't nearly as evolved. Even

27:06

if you allow for some maturation of

27:08

the US market, it will still be

27:10

a very large capital market. It

27:12

may not be growing 15%. It may be growing

27:15

8% or 10%, but there are markets that haven't

27:17

even opened up yet. That if you're

27:19

early and you're willing to take risk

27:21

and make investments in those markets, I think there's

27:23

huge growth. How is Aries

27:26

positioning itself to get ahead of all

27:28

of those themes that you mentioned? Yeah,

27:30

we're making investments and we're executing on

27:32

the same playbook. We

27:34

have a fully developed origination

27:36

and investment footprint across the

27:38

Asia Pacific region. We're

27:41

putting people in offices with a really diverse

27:43

set of product to go find deals. It's

27:45

like the old days here. Maybe

27:48

you asked the question earlier about what it was

27:51

like back then. When you go into these markets,

27:53

you do get a feel, you get a little

27:55

taste of the good old days because they're running

27:57

around these markets in a way that we were

27:59

here. 25, 30 years ago. So you

28:02

got to do that. And then in certain parts of

28:04

the world, for example, we have a partnership with Vinci

28:06

Partners, which is a Latin American based

28:08

alternative asset manager. We have a long

28:10

term view that the Latin American markets

28:13

will evolve and open up over time.

28:16

It's a little bit too far afield for us to take

28:18

on right now. So we're doing it through

28:20

partnership. But again, we're keeping those options open, right? We

28:22

want a front row seat to the development of these

28:24

markets. And so if we can't do it directly, we're

28:27

going to do it through partners who can help educate

28:29

us so that when those markets turn, we want to

28:31

be there. Whenever something gets really

28:33

hot, there are inevitably questions. And some

28:36

people wonder if private credit can stay

28:38

hot if rates fall. And conversely, some

28:40

worry that rising rates will be a

28:42

problem for private credit because borrowers could

28:44

have a harder time paying back their

28:46

floating rate loans. But I want your

28:48

perspective. How do you think about the

28:50

dynamic between interest rates and direct lending

28:53

returns? It's always one of those things

28:55

to your point when things get quote unquote hot. People

28:57

always worry that there's risk there that they

28:59

don't understand. And I get that because sometimes

29:01

it's true. And sometimes when something

29:04

is too good to be true, it

29:07

could just be that good. So the

29:09

reason that private credit is so attractive

29:12

is it's a floating rate

29:14

asset, short duration, self structured,

29:16

self negotiated, actively managed in

29:18

partnership, usually with some sophisticated

29:20

owner of a company or

29:22

an asset. And the components

29:24

of return are upfront fee, base

29:26

rate, credit spread and some form

29:28

of call protection. And so

29:30

the way the asset class functions is when

29:33

rates go up, credit spreads moderate.

29:35

And if rates are going down

29:38

in response to weakening economic fundamentals,

29:40

credit spreads gap out. So

29:42

if you look at the history, at least through the

29:44

Aries lens, while you make more

29:46

money in markets like this, you don't give

29:48

it back when rates start to recede, because

29:50

when they do, you're either

29:52

restructuring some parts of your book and

29:55

getting incremental compensation and then the new

29:57

loans that you make are coming at

29:59

significantly wider. credit spread that tend

30:01

to overcompensate for whatever the reduction

30:03

in the base rate is. So,

30:06

it presents a surprisingly stable total

30:08

return to the investor. I think

30:10

that's one of the reasons why it's

30:13

getting so much uptake in the investor

30:15

community because when you go back and

30:17

you actually underwrite the history of returns,

30:19

it's durable. We're making money when rates

30:21

are going up. We're making money when

30:23

rates are going down. We're making money

30:25

in volatile markets and good markets, but

30:27

it's the components of return change. We

30:29

do have to have the full product

30:31

set and ability to move around those

30:34

different components, which speaks again to the

30:36

scale of your capital, how flexible is

30:38

it to pivot and move. But if

30:40

you can, you're going to capture whatever

30:42

the market return is and generally it's

30:44

pretty range-bound. You've also been

30:46

leaning into asset-based lending or alternative credit

30:49

as a growth area over the last

30:51

five years. And for our listeners, can

30:53

you explain what that is, where you

30:55

see that going, and are there other

30:58

growth areas for areas that you're looking

31:00

to build up, including you talked about

31:02

Latin America, but from other geographic perspectives?

31:05

Yeah. So, alternative credit and asset-based finance

31:07

is probably one of the hotter corners

31:09

of the, as you described, hot private

31:12

credit market. And I think

31:14

that's a function of a couple of things.

31:16

One, it is squarely in the middle of

31:18

this bank balance sheet conversation that has been

31:20

happening over the last two years. Two,

31:23

with the continued growth in

31:26

alternative asset manager affiliated insurance

31:28

platforms, you're beginning to see

31:30

more linkage between those

31:33

insurance companies and the growth in

31:35

the rated side of the asset-based

31:37

finance market. And three, as

31:40

we are getting larger and folks like us

31:42

are getting larger, we're able to aggregate capital

31:44

and teams against this market opportunity in a

31:46

way that we couldn't 10

31:48

years ago. And it's simplest form in the

31:50

way that we think about it, if direct

31:53

lending is lending directly to a company or

31:55

to an asset, alternative credit is

31:58

lending to a of

32:00

assets, so long as those assets

32:02

generate cash flow. And so

32:04

that's everything from auto

32:06

receivables, credit card receivables,

32:09

shipping container leases, music

32:11

royalties, healthcare royalties, net

32:13

lease, residential solar securitizations. There's

32:16

20 plus end markets that we

32:18

participate in. And

32:20

what's so exciting about that, what I've always

32:23

loved about the private markets business is everywhere

32:25

you look is a private company. Whoever makes

32:27

the components on the microphones that we're speaking

32:29

into is a family owned company somewhere. And

32:31

when you get into the deep world of

32:34

alternative credit, things you do in your daily

32:36

life creates an asset with cash flow attached

32:38

to it. So when you start to really

32:40

walk down the street, and in fact, if

32:42

I pointed back, once you see it, you

32:45

can't unsee it. I look

32:47

around and all I see are securitizable

32:49

assets. And that's a little sad. I

32:51

know, it's pathetic. That's what makes

32:54

a market, right? Exactly. Because that

32:56

is why it's getting so much attention. Because

32:58

I think people are understanding as

33:00

the comfort level with these structures is

33:03

improving and the flexibility of the capital

33:05

that's available to the aggregators of these

33:07

assets is also improving in terms of

33:10

the ability to innovate and customize. It's

33:12

a pretty big world. And so rightfully so,

33:14

I think it's getting a lot of attention. Other places

33:16

we're spending a lot of time are in and around

33:19

real assets. So real estate lending,

33:21

infrastructure lending, some of that is around

33:23

opportunistic, where we think that we're just

33:25

going to see the install base of

33:28

credit needs some form of refinancing to

33:30

the new rate environment. And some of

33:32

it is just secular opportunities like the

33:34

next wave of data center rollouts that's

33:36

going to require trillions and trillions of

33:38

both debt and equity to come into

33:41

the market that doesn't currently exist. All

33:43

right, before we get away from your core business,

33:46

I just have to ask you from your seat,

33:48

how are you thinking about the economic outlook right

33:50

now? Because you sit atop of an

33:53

important global firm. And

33:55

we've seen widespread recession concerns

33:58

move to a fairly constructive end. outlook

34:00

for the economy globally. So how are

34:02

you thinking about the economic outlook right

34:04

now? It's hard to have

34:06

a single answer for a global picture, but

34:08

we do touch a lot of small companies

34:10

and assets and asset owners. And I would

34:12

say generally the tone is still very constructive.

34:15

We have been consistent in that view for at

34:17

least two plus years. So we were never on

34:19

the recession train. One of the benefits of having

34:22

the business we have is we're

34:24

getting real time information from our portfolios

34:26

and it's been constructive. Our

34:28

corporate portfolios are still growing in the

34:30

low double digit EBITDA range. Our real

34:33

estate portfolios are growing in a Y.

34:35

So it's clear that growth will slow. It is

34:38

slowing. The consumer is quite resilient now and

34:41

we're not alone in this view. I think

34:43

you're probably seeing it in your client base.

34:45

I think the commercial banks are seeing

34:47

it in their client base. And most of our private

34:49

credit peers, while we've seen some cracks

34:51

form in certain portfolios, I think

34:54

are generally running at default rates

34:56

significantly lower than historical average. I'm

34:58

still pretty constructive. Labor market's tight.

35:01

The system's working. So we've absorbed

35:03

a pretty significant rate shock

35:05

and nothing has in fact broken and

35:07

we're running in a good place here.

35:09

Yeah, I remain constructive. I'm happy to

35:12

hear that. Yeah. I'm going to leave here and a piano

35:14

is going to fall on my head by the way. No, no, no,

35:16

that won't happen. Not outside Goldman Sachs. So

35:18

you also have a family of funds called

35:20

the Pathfinder Funds. And I think these are

35:23

pretty amazing. Can you tell our listeners how

35:25

they work? Yeah, this is

35:27

one of the things I'm most proud of.

35:29

And we had a portfolio manager that joined

35:31

us, gosh, five or six years ago named

35:34

Joel Holsinger to start to guide

35:36

us through the next evolution of the growth

35:38

of our alternative credit business. And he had

35:40

an idea which we took

35:43

to that we wanted to have 10

35:45

percent of the carried interest in those

35:47

funds go to charitable causes that were

35:49

near and dear to his and his

35:51

team's heart. And we

35:53

had a very long conversation back

35:55

to the sense of purpose in

35:57

investing of aligning the profit we

36:00

generated to doing

36:02

good in the world, right? Do good, do well. And

36:05

so that was an eye

36:07

opening moment for us, because what we

36:09

saw was it changed the conversation internally

36:11

back to culture. And these are large

36:14

funds, right? This is a 40 billion

36:16

dollar business at this point. And we

36:18

very then quickly pivoted to stand up

36:20

the Aries Charitable Foundation, which was we

36:23

were going to take a percentage of

36:25

our promote and contribute it into the

36:27

Charitable Foundation and align

36:29

our performance to impact work.

36:32

And what's so exciting and cool about it

36:34

is the work that we're doing is in

36:37

areas where we actually can make a difference,

36:39

financial literacy, entrepreneurship, social equity.

36:42

And so we're going into the communities where

36:44

we live and work and invest, and we're

36:46

actually able to take our profit and put

36:48

it back in. And it's been really empowering

36:51

for our teams and our investors, because again,

36:53

I think they see our teams approaching their

36:55

business with a deeper sense of responsibility than

36:58

they were before. And it's

37:00

so funny how when you do something like

37:02

that and people see it, now I think

37:04

we have 10 teams around the firm that

37:06

are doing the same thing. They

37:08

said, I love what they did. I want

37:10

to do it too. And they're raising their

37:12

hand and doing it. So back to the

37:14

culture conversation, that's something that just happened organically,

37:16

right? We had to make the first

37:19

step. We had to be pushed to do it

37:21

and recognize it. But then once we did it,

37:23

it just took off. But that

37:25

says a lot about the people. It varies

37:27

because people want to work for mission-driven organizations.

37:29

Yeah, I think so. And

37:31

it probably helps you attract and retain your

37:33

talent too. All right, so I can't let

37:35

you go without asking you about the Baltimore

37:38

Orioles baseball team. I will

37:40

admit I'm a Yankees fan, so just

37:42

saying. But you're part of a group

37:44

that bought the baseball team along with

37:46

Carlisle Group's co-founder David Rubenstein earlier this

37:48

year. And are there any

37:50

lessons that you learned from running Aries

37:52

that you're applying to the way you

37:54

manage the Orioles team? It's

37:57

a great question. We have a large

37:59

sports and investing business. at Aries. So, away

38:01

from my deep involvement with the Orioles, I've

38:03

had an opportunity to kind of understand the

38:05

business of sports. The first thing I would

38:07

say is there's a real opportunity just to

38:10

modernize the business, right? A lot

38:13

of sports franchises, the Orioles

38:15

included, for better or for worse, are

38:17

family owned. They've been family owned for

38:19

decades, if not generations. And so, the

38:21

ability to come in with

38:24

a partner like David and bring best

38:27

practices in business to what

38:29

was effectively a family run business is pretty

38:31

exciting. So, there's just a lot to do

38:33

there. But maybe back to sense of purpose,

38:36

both David and I believe that the

38:38

Baltimore Orioles, while we own them, is

38:41

a community asset, right? And if

38:43

done well and the community

38:45

is appropriately engaged, you can have a

38:47

real impact on the city of Baltimore, right?

38:50

And so, we've tried to take that same

38:52

sense of responsibility and come in with

38:54

all humility and just say, if we could

38:56

do better here, meaning if we can

38:58

run a better business, if we can continue

39:01

to sustain great performance and ignite the fans,

39:03

if we can bring the community around

39:05

this thing, game changer for the city. And

39:07

so, we're having a lot of fun,

39:09

don't get me wrong. But we're doing it

39:11

in a way that I think is somewhat

39:14

unique in sports ownership in terms of

39:16

just the way that we're approaching

39:18

community engagement, the way that we're even engaging with

39:20

the fans in the stadium. And to your point,

39:22

it's different. In the old days, owners of sports

39:25

teams would sit up in some... Right box. ...

39:27

behind some dark window, never to be seen. And there was

39:29

this separation. And

39:33

the same way I think that the younger

39:35

generation of workers in our business want mission

39:38

and they want to be part of

39:40

something bigger and they want relatable leaders,

39:42

I think the same is true for

39:44

sports. So, when you walk around the

39:46

stadium as a fan, it's amazing how

39:48

engaged the fans feel with you and

39:50

the team. So, that was a big

39:52

lesson there of just kind of leaning

39:54

in on that because not necessarily what's

39:56

been done before, but it's still early.

39:58

But if the results... or any indication

40:00

it's working. Certainly is. So

40:03

we like to end these sessions with a lightning round. So

40:05

we're going to run through a couple of questions and just

40:07

to get a quick answer from you. Like

40:09

a one word answer. If you can

40:11

make one, two, three, try. I'm not that good

40:14

at short answers, but I'm going to try. OK.

40:16

So what was your first investment? First

40:18

investment was Charms Blow Pops that

40:20

I would buy for a nickel

40:23

in large bags, chop them up, and sell them

40:25

for $0.25 on the bus. Made

40:28

a killing. OK, I love that story. How

40:30

old are you when you did that? I was

40:33

probably 12. An entrepreneur from a young age. What

40:36

is your greatest strength as an investor? Healthy

40:38

skepticism, taking it slow. So

40:41

what's the best piece of advice that you have

40:43

ever received? All you have is

40:45

your reputation. I 100% agree with that. Which

40:49

investor do you admire most? Oh,

40:52

gosh, there's so many. I'm going

40:54

to go with Charlie Munger. It's

40:56

amazing how many people I interview on the show that

40:58

say that or Warren himself.

41:01

So how about your biggest mentor? Who's been your

41:03

biggest mentor? I've been fortunate to

41:05

have so many, both peer mentors and senior mentors.

41:08

This is someone we talked about earlier. I would

41:10

say John Kisek. You were lucky to have

41:12

him as mentor. Yes, I was. One of the highlights of

41:14

my life. So where do you spend your time

41:16

outside of the office? Oh,

41:18

gosh, golfing, fishing, playing the

41:20

guitar, Camden Yards, skiing.

41:24

And obviously, I have two teenage boys, so I try to spend

41:26

as much time with them as I can as well. Are

41:29

they baseball fans? They're Yankee fans. So we're

41:31

having a real problem in the Arrogate household

41:33

right now. All

41:36

right, so finally, what are you most excited about in

41:38

the world right now? I try. This

41:41

is not going to be a short answer, but I just

41:43

forgive me for this one. I struggle

41:45

today just given the pace

41:47

of information and all of

41:49

the headlines and speed

41:52

of news that we're losing the narrative. And so

41:54

what I'm actually most excited about is when you

41:56

just zoom out and you try not to get

41:58

caught up in the muck. the

42:00

arc of human progress is actually quite

42:03

remarkable, right? I mean, we're making huge

42:05

strides in global poverty reduction and medical

42:07

advancements and life expectancy. And I always

42:09

try whenever I'm getting sucked into the

42:12

headlines and all the partisan divisiveness just

42:14

to take a breath and kind of

42:16

get some historical perspective because there's a

42:18

lot to be excited about just in

42:20

terms of where we are and all

42:23

of the great things that happen day

42:25

to day that I think people take

42:27

for granted. It's good advice. So,

42:30

Mike, it was a pleasure having you on the

42:32

show. Thank you for joining us and sharing your

42:34

fascinating perspectives. It was a real treat. Thank you. So

42:36

thank you all for listening to this

42:39

special episode of Goldman Sachs exchanges, Great

42:41

Investors. I'm Alison Mass. This podcast was

42:43

recorded on June 4th, 2024. If

42:46

you enjoyed the show, we hope you

42:49

will follow us on Apple podcasts, Spotify,

42:51

YouTube or wherever you listen to your

42:53

podcasts. And leave us a rating and

42:55

a comment. The

43:00

opinions and views expressed in this program

43:02

may not necessarily reflect the institutional views

43:04

of Goldman Sachs or its affiliates. This

43:06

program should not be copied, distributed, published

43:09

or reproduced in whole or in part

43:11

or disclosed by any recipient to any

43:13

other person without the express written consent

43:15

of Goldman Sachs. Each name

43:17

of a third party organization mentioned in

43:19

this program is the property of the

43:21

company to which it relates is used

43:23

here strictly for informational and identification purposes

43:26

only and is not used to imply

43:28

any ownership or license rights between any

43:30

such company and Goldman Sachs. The content

43:32

of this program does not constitute a

43:34

recommendation from any Goldman Sachs entity to

43:36

the recipient and is provided for informational

43:39

purposes only. Goldman Sachs is not providing

43:41

any financial, economic, legal, investment, accounting or

43:43

tax advice through this program or to

43:45

its recipient. Certain information contained

43:47

in this program constitutes forward looking statements

43:49

and there's no guarantee that these results

43:51

will be achieved. Goldman Sachs has no

43:54

obligation to provide updates or changes to

43:56

the information in this program. Past performance

43:58

does not guarantee future results. which

44:00

may vary. Neither Goldman Sachs nor any

44:03

of its affiliates makes any representation or

44:05

warranty express or implied as to the

44:07

accuracy or completeness of the statements or

44:10

any information contained in this program and

44:12

any liability therefore, including in respect of

44:14

direct, indirect, or consequential loss or damage,

44:17

is expressly disclaimed.

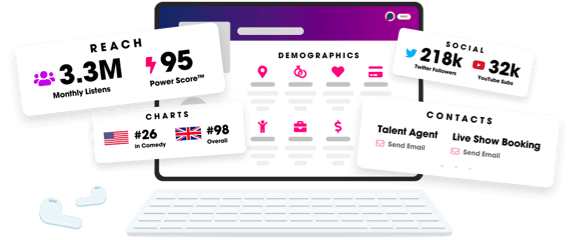

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us